4/24 Blog Topic: One Up, One Down: Why Residential and Commercial Vacancy Rate Trends are Troubling

April 24, 2019

Here at MEF we are always analyzing data to understand our local economy. Recently I reviewed datasets on residential and commercial real estate vacancies in Marin. The trends and what they suggest are concerning for our economy.

According to multiple Marin commercial real estate reports, office, retail and industrial vacancies are increasing. San Rafael and Novato have well over 1 million square feet (sq. ft.) vacant space in all categories combined and both cities experienced a net increase of availability for 2018. While that is not a lot of vacant space, the fact that vacancies have gone up when there has not been any significant commercial developments for the last decade suggests companies may be leaving those cities (and possibly leaving Marin) or downsizing. A well-known leasing agent also confirmed lack of demand with few property showings and noted “it doesn’t seem like we have the startup, job creation, or the person tired of commuting to the City that wants to open up an office here.”

That is a bad trend for Marin’s economy and for residents that depend on local businesses for goods or public services funded by the taxes those businesses pay. From a local resident employment perspective, it is even worse. If you consider a ratio of 200 sq. ft./office worker, there is a lost opportunity for local jobs that would reduce residents need to commute out of Marin and pump extra cash into the local economy. So, any way you look at it the increasing vacancy rate of commercial office space is hurting our local economy.

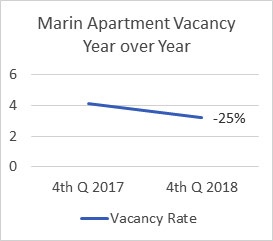

On the residential side we are seeing the opposite; vacancies continue to go down. According to MarinApartments.com, the apartment vacancy rate in the 4th quarter of 2018 was 3.2%, almost a full point lower than the same period in 2017 (4.1%). A decline in vacancy rates suggests that rents are likely to continue rising. According to CoStar Group, Marin’s average apartment rents at $2,463 per month. Since landlords typically require an income of 4X rent, a family would need an income of $100,000 to secure adequate housing. According to the 2017 Census, only 52% of Marin households had incomes of $100,000 or more confirming many Marin residents cannot afford to pay the average rent of an apartment.

You don’t have to be a data geek like me to understand how the two opposing trends pose deeper threats to our economy. Residents will feel the impact of local businesses closing or diminished job openings, especially of higher wage service jobs, because companies can’t suitably locate here. Meanwhile, as housing costs continue to increase there is less disposable income that goes towards eating out, shopping and buying new vehicles-all major contributors to Marin’s economy. I see this as a concern, and I hope you do too.

Mike Blakeley, CEO

Marin Economic Forum

Tags: blog